Representatives of SID Bank, the European Investment Fund (EIF) and fund managers presented new possibilities for equity financing within the extension of the SEGIP program at the House of the European Union in Ljubljana. The first SEGIP extension of EUR 20 million was adopted in July 2021 to establish a venture capital fund for technology transfer, and the second of EUR 100 million at the end of March to establish a venture capital fund for start-ups and private equity fund to finance succession in family businesses.

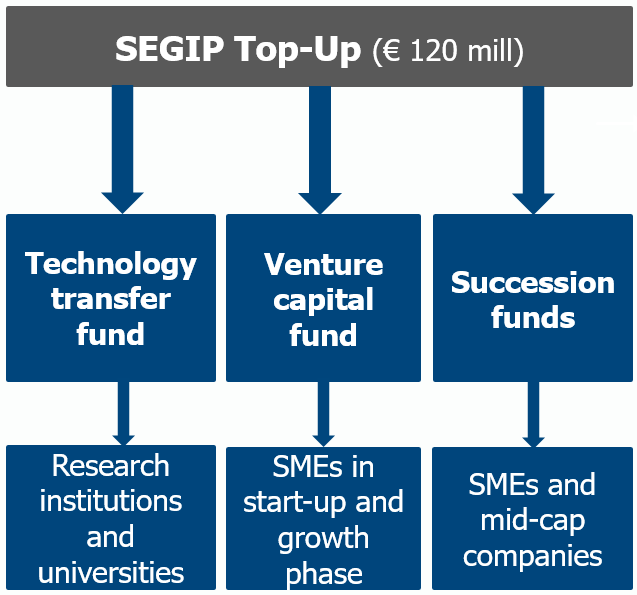

The Slovenian Investment Program for Capital Growth (SEGIP) addresses the market gap in the field of equity financing in Slovenia, develops the equity financing environment and helps to obtain funds from private investors for equity financing of Slovenian companies in the growth phase. This type of financing is intended to provide sufficient capital for the growth and expansion of companies, increase productivity and added value of companies, create new jobs, support the export and internationalization of companies in the growth phase. With the establishment of SEGIP in 2017 and together with private capital, over 12 Slovenian companies in the total amount of almost EUR 75 million have been financed to date. Due to the success of the SEGIP program, we top-upped SEGIP (the “SEGIP Top-Up” initiative) by additional EUR 120 million.

SID Bank and the EIF will each invest EUR 60 million in the SEGIP Top-Up. SEGIP Top-up includesof three additional activities to establish a Venture Capital Fund for Technology Transfer, a Venture Capital Fund to finance Start-ups as well as Private Equity Funds, which address the issue of ownership successions in family businesses.

Venture Capital Fund for Technology Transfer

The fund is intended for financing research projects, technology development and intellectual property at universities and research institutions (in Slovenia and Croatia) with potential commercial value for the economy in their earliest stages when they are still in the domain of research groups at universities and research institutes. In cooperation between SID Bank, EIF and Croatian Development Bank (HBOR), a regional platform (CEETT platform) was established in the amount of at least EUR 40 million (SID bank 10 mill, EIF 10 mill and HBOR 20 mill), through which research projects of universities and research institutes will be financed with the help of the Venture Capital Fund in Slovenia and Croatia in the Proof-of-Concept phase with the aim of commercialization, and newly established companies, that were created by transferring realized projects from universities and research institutions to companies (so-called "spin-offs/outs"). The CEETT platform is the first example of cross-border cooperation supported by InvestEU funds.

Venture capital fund to finance start-ups

The purpose of the fund is to provide financial support and assets in the form of equity and quasi-equity financing through SEGIP – Top Up to young Slovenian innovative small and medium-sized enterprises in the early stages of development, especially in the start-up phase, and in the phase of rapid growth, who have difficulty accessing financing through commercial banks. The aim of establishing a venture capital fund is to reduce the market gap in providing funds to newly established SMEs and to encourage greater innovative entrepreneurial activity and support the further development of the venture capital ecosystem. According to Invest Europe statistics, increasing the volume of such financing of start-ups, the creating venture capital funds with an investment focus in Slovenia and developing Slovenian fund managers, are among the least developed in the EU.

Private equity funds to address the issue of succession in family businesses

The purpose is to address the problem of succession in family businesses in Slovenia (especially SMEs and small mid-cap companies), where companies stop operating, get sold by parts or are under duress due to the lack of family or relative successor or their unwillingness to take over company ownership and management in case of withdrawal of the current owner. The problem of ownership succession is also addressed, where the family heir does not have sufficient funds to take ownership and pay the remaining family members upon the exit of the current owner. It also solves the problem of the existing owner, who has insufficient funds to finance the further growth of the company, but still wants to remain a co-owner of the company. With this funds, we are the only ones in Slovenia to address one of the potentially biggest problems of the Slovenian and European economy.

President of the Management Board of SID Bank, Damijan Dolinar, at the presentation said: »We have been creating various successful Slovenian stories for 30 years with long-term successful debt financing programs for research, development projects and innovations and SEGIP. In the field of equity and quasi-equity financing in start-ups, Slovenia for now lags behind most European countries, also in comparison with other countries in Central and Eastern Europe. Mainly due to this market gap, we are ready to enter even more strongly in the field of equity financing, which is not typically banking, but has great development and economic potential. For several years now, SID Bank has been striving to strengthen the connection between research institutions and the economy, as we want Slovenia once again be one of the leading innovators. Investing in innovative start-ups is closely linked to the level of innovative activity and, consequently, the competitiveness of the economy. Last year, with the expansion of the SEGIP program, together with the EIF and the Croatian Development Bank, we supported the establishment of the first regional CEETT platform, intended for financing innovative technological research projects and their commercialization into the economy. This year, together with the EIF, we expanded the SEGIP program to finance newly established Slovenian small and medium-sized enterprises in the start-up phase and the rapid growth phase. Financing will be provided through venture capital funds registered in Slovenia, which will enable further development of the venture capital ecosystem in Slovenia. The second part of the funds is intended for addressing the issue of ownership succession in Slovenian family businesses, where it wants to prevent the closing of the companies due to the lack of family successor or their unwillingness to take over the ownership and management upon the withdrawal of the current owner. Through private equity funds, this would enable the financing of the entry of members of management or strategic investors, thus ensuring the continued operation, growth and development of family businesses. I believe that new funds will contribute the further development and progress of the competitiveness of the Slovenian economy.«

President of the Management Board of SID Bank, Damijan Dolinar, at the presentation said: »We have been creating various successful Slovenian stories for 30 years with long-term successful debt financing programs for research, development projects and innovations and SEGIP. In the field of equity and quasi-equity financing in start-ups, Slovenia for now lags behind most European countries, also in comparison with other countries in Central and Eastern Europe. Mainly due to this market gap, we are ready to enter even more strongly in the field of equity financing, which is not typically banking, but has great development and economic potential. For several years now, SID Bank has been striving to strengthen the connection between research institutions and the economy, as we want Slovenia once again be one of the leading innovators. Investing in innovative start-ups is closely linked to the level of innovative activity and, consequently, the competitiveness of the economy. Last year, with the expansion of the SEGIP program, together with the EIF and the Croatian Development Bank, we supported the establishment of the first regional CEETT platform, intended for financing innovative technological research projects and their commercialization into the economy. This year, together with the EIF, we expanded the SEGIP program to finance newly established Slovenian small and medium-sized enterprises in the start-up phase and the rapid growth phase. Financing will be provided through venture capital funds registered in Slovenia, which will enable further development of the venture capital ecosystem in Slovenia. The second part of the funds is intended for addressing the issue of ownership succession in Slovenian family businesses, where it wants to prevent the closing of the companies due to the lack of family successor or their unwillingness to take over the ownership and management upon the withdrawal of the current owner. Through private equity funds, this would enable the financing of the entry of members of management or strategic investors, thus ensuring the continued operation, growth and development of family businesses. I believe that new funds will contribute the further development and progress of the competitiveness of the Slovenian economy.«

Head of Division, Mandate Management – Equity, EIF, Gabriele Todesca: »Today we are expanding SEGIP and with it the financial support available to Slovenian SMEs and start-ups. At the same time, we are making a valuable contribution to the faster development of the financial sector in Slovenia and the Slovenian economy as a whole. I am very grateful to SID Banka for the opportunity to contribute to a competitive, fast-growing Slovenia and five years of successful implementation of SEGIP.«

Tone Pekolj (Alfi PE), Natalija Stošicki (SID banka), Luka Podlogar (Generali Investments), Damijan Dolinar (SID banka), Jerneja Jug Jerše (House of EU), Gabriele Todesca (EIF), Andrea Marcello Grimani (EIF)

About SEGIP

In 2017, SID Bank and the EIF established the EUR 100 million (SID bank and EIF each invested EUR 50 million) Slovenian Capital Growth Investment Program – SEGIP, for equity and quasi-equity financing Slovenian SMEs and mid-cap companies in the growth phase. SEGIP addresses the market gap in the field of equity financing in Slovenia, develops the equity financing environment and helps to obtain funds from private investors for equity financing of Slovenian companies in the growth phase. This type of financing is intended to provide sufficient capital for the growth and expansion of companies, increase productivity and added value of companies, create new jobs, support the export and internationalization of companies that are in the growth phase. Of the EUR 100 million of SEGIP funds, EUR 50 million was intended for private equity funds with Slovenian managers selected by the EIF based on a public tender. As private equity fund managers, the ALFI PE d.o.o. fund and Generali Investments d.o.o. fund were selected. In addition, both selected companies obtained an additional EUR 85 million from trained private investors.

Call for Expression of Interest

Invitation to financial intermediaries to apply within the Slovenian Capital Growth Investment Program (SEGIP-TOP UP)

The deadline for submitting tenders is 30 June 2022, in accordance with the instructions published on the EIF website (Link to the EIF website).

Venture Capital Fund for Early Development Investments (VC Fund)

Call us at +386 1 200 75 00 or e-mail us at info@sid.si